The Public Provident Fund (PPF) and equity-linked saving schemes (ELSS) are popular investment options that both qualify for income tax deductions. A deduction reduces your overall tax liability. Contributions up to Rs. 1.5 lakh a year qualify for tax deduction under Section 80C. Financial planners say that when it comes to investments in the PPF and ELSS mutual funds, investors should look at these investments not just from a tax-saving perspective but one that will help achieve their financial goals. ELSS mutual funds invest in equity shares of companies across sectors and market capitalization and have a three-year lock-in.

An ELSS mutual fund is quite the same as a diversified equity fund, other than tax deduction benefits and the three-year lock-in. ELSS investments come with a lock-in period of three years, which is lowest among Section 80C investments. Investors should understand ELSS mutual funds are equity market-linked products.

An ELSS mutual fund is quite the same as a diversified equity fund, other than tax deduction benefits and the three-year lock-in. ELSS investments come with a lock-in period of three years, which is lowest among Section 80C investments. Investors should understand ELSS mutual funds are equity market-linked products.

1) The PPF is a 15-year government-backed savings option offered through banks and post offices. Thereafter, it can extended further in batches of five years.

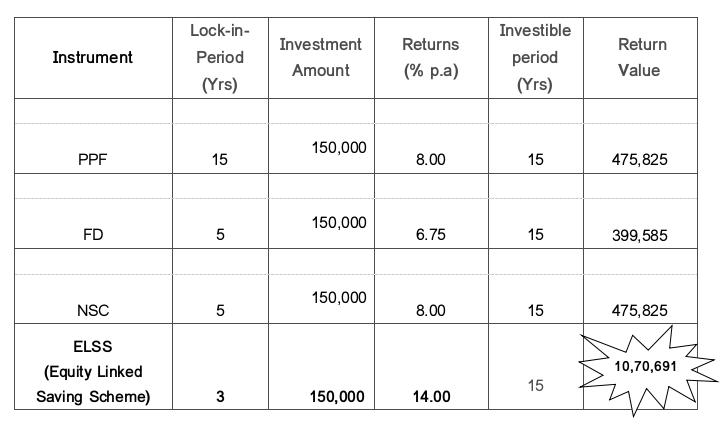

2) The interest rate on the PPF is revised every quarter and is benchmarked to yields on government securities. Currently, the PPF fetches an interest rate of 8%. Whereas in case of ELSS return is on an average 14 – 15%.

3) In the PPF, you can maximize your returns by investing early in the financial year so that your deposits can earn interest for the entire year.

4) The minimum amount that must be deposited in a PPF account in a financial year is Rs. 500 and the maximum allowed is Rs. 1.5 lakh.

5) Premature closure of a PPF account is allowed only under specific conditions such as expenditure towards medical treatment. For this, a PPF account must have completed at least five financial years.

6) Apart from income tax benefits, the ELSS is suitable for conservative investors who are looking at long-term financial goals like a child’s education or retirement, say financial planners.

7) ELSS or tax-saving mutual schemes have a three-year lock-in period. You can partially or fully redeem your ELSS or tax saving mutual fund investments after three years.

8) Financial planners suggest investors to opt for systematic investment plans (SIPs) in tax saving mutual funds to help spread their spread their investments throughout the year.

9) The lock-in of three years also applies to SIPs. In other words, every SIP installment in a ELSS fund is subject to a three-year lock-in.

10) Long term capital gains from equity mutual funds, including ELSS funds, above Rs. 1 lakh will be taxed at 10%. ELSS funds come with both growth and dividend options. It is suggested that investors should go for the growth option and not for the dividend option.

2) The interest rate on the PPF is revised every quarter and is benchmarked to yields on government securities. Currently, the PPF fetches an interest rate of 8%. Whereas in case of ELSS return is on an average 14 – 15%.

3) In the PPF, you can maximize your returns by investing early in the financial year so that your deposits can earn interest for the entire year.

4) The minimum amount that must be deposited in a PPF account in a financial year is Rs. 500 and the maximum allowed is Rs. 1.5 lakh.

5) Premature closure of a PPF account is allowed only under specific conditions such as expenditure towards medical treatment. For this, a PPF account must have completed at least five financial years.

6) Apart from income tax benefits, the ELSS is suitable for conservative investors who are looking at long-term financial goals like a child’s education or retirement, say financial planners.

7) ELSS or tax-saving mutual schemes have a three-year lock-in period. You can partially or fully redeem your ELSS or tax saving mutual fund investments after three years.

8) Financial planners suggest investors to opt for systematic investment plans (SIPs) in tax saving mutual funds to help spread their spread their investments throughout the year.

9) The lock-in of three years also applies to SIPs. In other words, every SIP installment in a ELSS fund is subject to a three-year lock-in.

10) Long term capital gains from equity mutual funds, including ELSS funds, above Rs. 1 lakh will be taxed at 10%. ELSS funds come with both growth and dividend options. It is suggested that investors should go for the growth option and not for the dividend option.

Comparing Tax Saving Instruments u/s 80C – ELSS

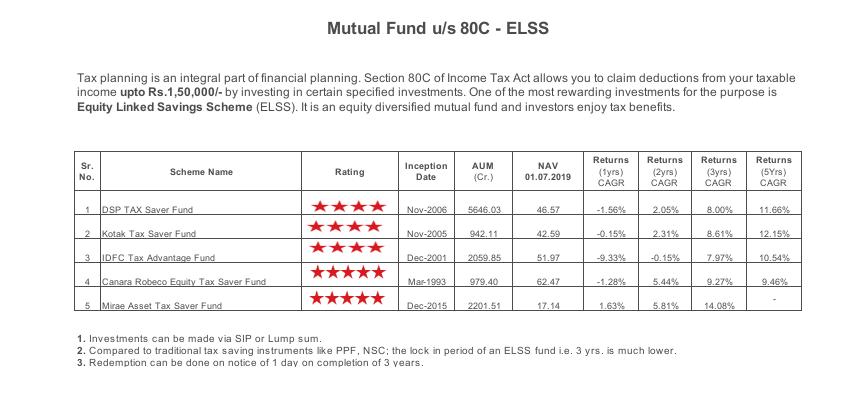

We suggest the following funds for the ELSS investments:

About Nidhi Broking Services:

Nidhi Broking Services is one of Mutual Fund Consultant in Thane. We offer services like NRI Investments, Equity Trading, IPO, Debentures, Mutual Funds, etc.

Talk to us On 022 - 2530 3690 / 022 - 2530 1134 Or Whatsapp us on +91 70391 78941 Or Email us at info@nidhibroking.com

Happy to help!

Talk to us On 022 - 2530 3690 / 022 - 2530 1134 Or Whatsapp us on +91 70391 78941 Or Email us at info@nidhibroking.com

Happy to help!

No comments:

Post a Comment